Punch these codes into your ordinary brokerage account (From Brownstone Research)

Quick Look

- Fortinet’s bullish analyst upgrade lifted the cybersecurity sector and may signal a valuation floor for CRWD stock.

- Despite AI-related concerns such as “vibe coding,” CrowdStrike’s strong ARR growth suggests that demand for cybersecurity remains durable.

- With shares near key support ahead of earnings, CRWD stock could be approaching an inflection point for investors.

CrowdStrike Holdings Inc. (NASDAQ: CRWD) stock has declined nearly 8% year-to-date amid broader market pressures. The general slump in technology stocks has become sharply focused on software stocks, including some of the top cybersecurity names.

However, analyst sentiment suggests that CRWD stock may be finding a floor ahead of its March earnings report. That theory started to play out on Jan. 23 when Fortinet Inc. (NASDAQ: FTNT) received a bullish upgrade from TD Cowen. The firm raised its rating on FTNT to Buy from Hold and set a $100 target.

In the immediate aftermath, FTNT shares powered higher, lifting the sector, including CrowdStrike. This sector momentum heading into earnings season suggests potential support for CRWD, potentially signaling that the entire cybersecurity sector is undervalued. If that’s the case, then CRWD stock could present an appealing entry point.

Gold has weathered every financial disaster in history, and it's up more than 100 percent in the last two years. But there's another reason to pay attention now. Since 1950, roughly 70 percent of all the gold on earth has already been mined. What remains is harder to find and more costly to extract. Supplies are running out at the exact moment the world needs gold to stabilize heavily indebted financial systems. A four-stock portfolio of top gold developers is now available, selling at an average 82 percent discount to asset value.

Get the four picks plus a bonus stock with potential for significant upside.

Is AI Really a Threat to Cybersecurity?

Apart from valuation concerns, which may be real, cybersecurity stocks like CRWD are being dragged down by broader concerns about the impact of artificial intelligence (AI) on software.

Specifically, there are concerns about “vibe coding.” This is where developers use tools like Cursor or GitHub Copilot for rapid prototyping. The concern is that fewer custom “seats” to charge as AI automates routine code, which will slash endpoint needs.

Not all software stocks can be painted with the same brush. Cybersecurity software has to comply with strict industry standards. For example, strict standards like NIST 800-53, SOC 2, and zero-trust frameworks demand audited, deterministic defenses, not probabilistic AI outputs prone to hallucinations.

It’s also too early to say that the use of AI will mean fewer seats for cybersecurity companies to charge clients. In fact, in virtually every technology shift, where some jobs are lost, others are created.

For example, Y2K compliance birthed a $100 billion industry as cloud migrations exploded endpoint security layers. The same thing is expected with AI. In its most recent quarter, CrowdStrike delivered 73% year-over-year net new annual recurring revenue (ARR) at $265 million. This is initial proof that AI is amplifying, not eroding, CrowdStrike’s revenue base.

What Analysts Are Thinking, But Not Saying

Analysts know this. But cybersecurity stocks are trading at eye-watering multiples. At 29x forward sales, CrowdStrike’s multiple looks expensive. However, the Falcon platform’s sticky retention rate justifies premiums when threats evolve faster than ever.

But right now it’s time to shake out the loose hands. That, more than anything, seems to be a key driver of the recent CRWD stock slump.

Does that mean blindly buying the stock? Probably not. CRWD stock doesn’t report earnings until March 3. A lot can change in that time.

If the company can show through its earnings that many of these concerns about the broader software industry don’t apply, CRWD stock is primed for a major rally.

The #1 Way To Play Gold Right Now

We're witnessing the greatest gold rush in over 50 years...

But one gold asset has outperformed miners, typical stocks, and gold itself for the last two decades.

Click to discover this little-known gold investment now

CRWD Stock at an Inflection Point

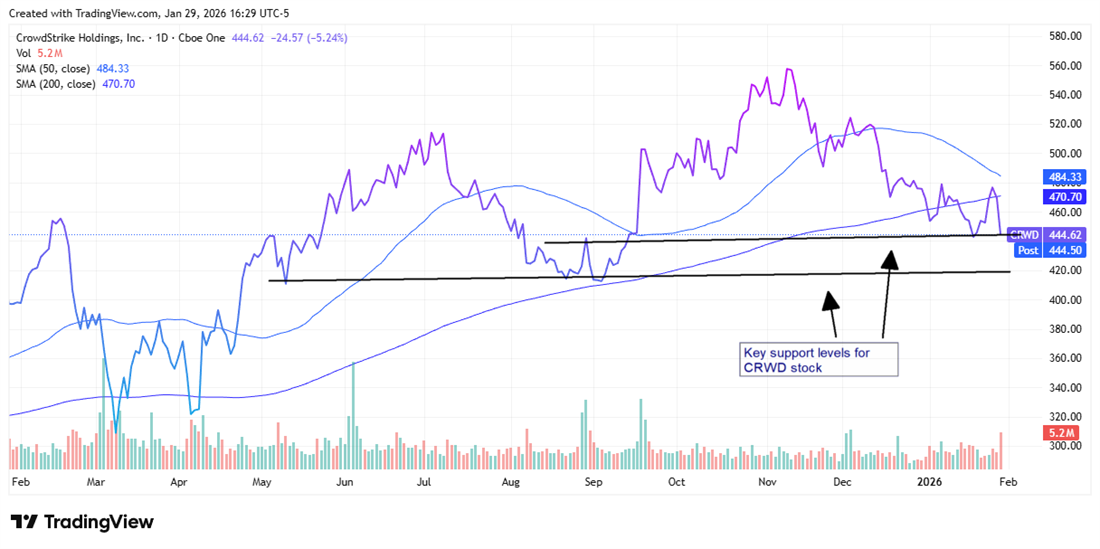

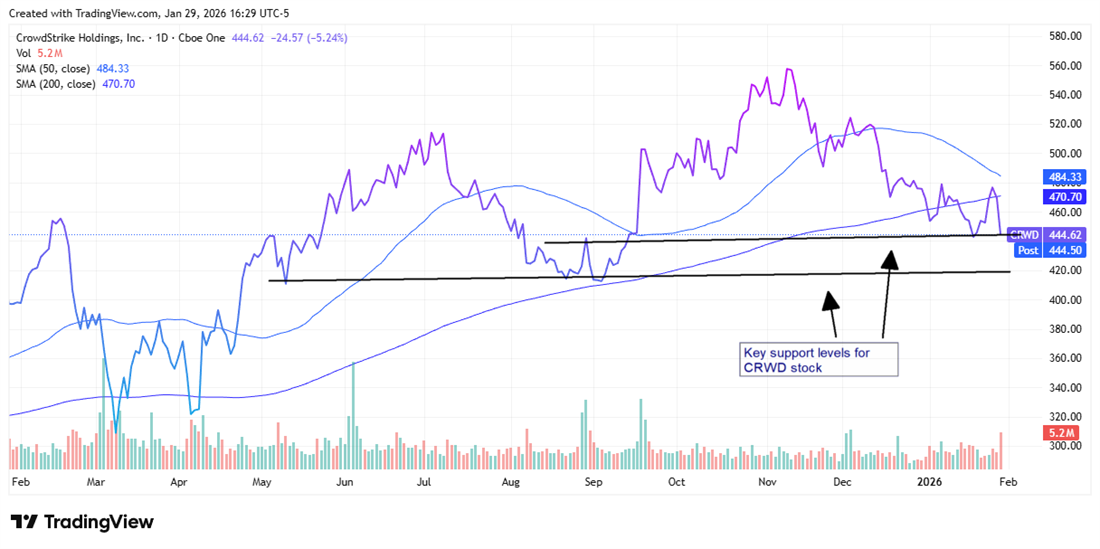

Prior to this recent sell-off, CRWD stock was breaking out of a bearish pattern that had been in place since November 2025. But the stock has once again plunged below its 50-day simple moving average (SMA). That puts it at a level that has acted as resistance on two separate occasions in 2025.

Key support levels align with prior lows around $413. A break below that could put the psychologically important $400 level in play.

But the stock is showing signs of being oversold. Nevertheless, a cautious approach before earnings seems warranted. At that point, the company should have more clarity as to what impact AI will have on its future earnings, and to what extent.

Read this article online ›

Stay Ahead of the Market

The best investment opportunities don't wait. Get our research and stock ideas delivered straight to your smartphone—so you never miss a market-moving opportunity. Our text alerts ensure you see timely stock ideas and professional research reports instantly, whether you're in a meeting, commuting, or away from your desk.

Get Text Alerts from American Market News (free)

No comments:

Post a Comment