"You can't prompt-engineer your way into creating the MSCI World Index." Karim Rahemtulla, Co-Founder, Monument Traders Alliance The AI panic sell-off just wiped out $2 trillion in software market cap. MSCI was caught in the crossfire because investors are conflating it with Salesforce and Palantir. That's like saying McDonald's and a farm are the same business because they both involve food. The "SaaS-pocalypse" started on February 3rd when Anthropic announced a legal AI plugin that could handle contract reviews and data analysis. Suddenly, everyone's panicking that AI will replace all software. The carnage was brutal: Microsoft down 16%, Shopify 26%, Adobe 27%, Salesforce 30%. Fair enough for pure SaaS plays. But MSCI isn't selling software that can be replaced by ChatGPT. MSCI sells financial data infrastructure. Indices, ESG ratings, risk analytics - the stuff that asset managers need to benchmark against and make decisions. You can't prompt-engineer your way into creating the MSCI World Index. The Market's Making the Wrong Comparison The market's treating these three like they're the same company: - Salesforce (CRM): Down 30%. Makes sense - AI could automate sales processes and CRM tools

- Palantir (PLTR): Trading at 165x P/E. Built on AI hype, dies by AI fear

- MSCI: Down 13% from its Feb highs. But they're a data company with subscription revenue tied to assets under management

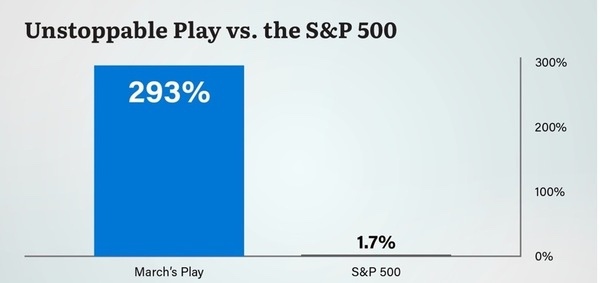

MSCI uses AI to enhance its analytics, but its moat isn't the AI - it's the proprietary datasets and methodologies that took decades to build. Good luck getting an LLM to replicate regulatory-compliant ESG scores or create globally accepted market indices. And if you don't believe me, all you have to do is look at the scoreboard. CEO Henry Fernandez just dropped $3.56 million buying shares at $517-$524. |

No comments:

Post a Comment