History Says This Bull Market Has Years - Not Months - Left to Run  | | Robert Ross

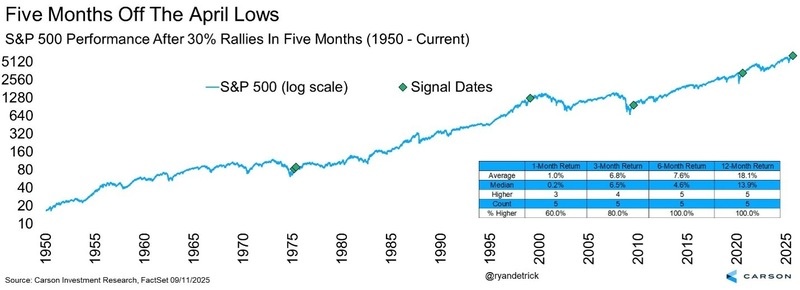

Speculative Assets Specialist | Every bull market feels dangerous while you're in it. Only in hindsight does it look obvious. Right now, stocks are sitting at all-time highs after a blistering run. It's easy to feel like things are stretched. And in the short term... they are. Technicals like the relative strength index (RSI) are overbought. Volatility is flashing warning signs. The S&P 500 just notched one of its fastest 30% rallies in history.

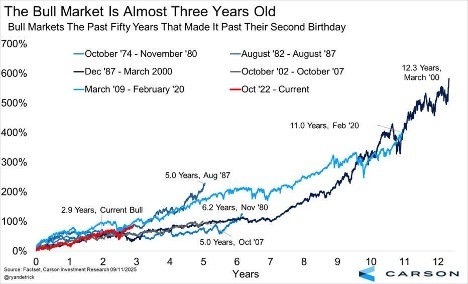

View larger image That kind of move doesn't go straight up forever. Pullbacks of 5% to 8% would be totally normal here. But let's zoom out. If history is any guide, this bull market is still in its early innings. Bull Markets Are Long... Bear Markets Are Short Go back through the last 50 years of market history and you'll find a clear pattern... Bull markets last a long time, while bear markets are brief and violent. Since the 1970s, we've seen only a handful of true bear markets... the 1973 oil crisis, the dot-com bust in 2000, the financial crisis in 2008, and the COVID crash in 2020. Each one lasted anywhere from a few months to a couple of years. Now compare that to the bull runs: - The post-World War II expansion lasted nearly two decades.

- The 1982-2000 bull market ran for 18 years.

- Even the much-maligned "lost decade" of the 2000s ended with a historic bull that carried from 2009 all the way to 2020.

On average, bull markets that make it past their second birthday last about eight years. The shortest in modern history ran five years.

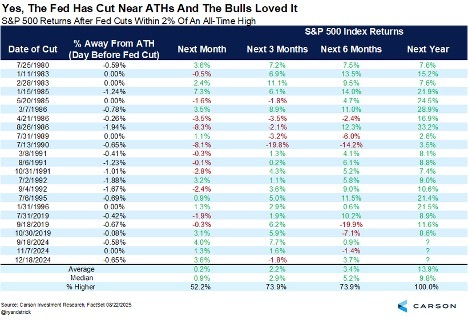

View larger image This current bull? It's not even three years old. Rate Cuts Near Highs Are Bullish, Not Bearish A lot of folks see the Fed cutting rates at all-time highs and assume it's a red flag. After all, the typical mental model for Fed cuts is that they happen when the economy is in trouble. But that's not what the data shows. In fact, the last 20 times the Federal Reserve cut interest rates while the S&P 500 was within 2% of an all-time high, the market was higher one year later 20 out of 20 times. A perfect record.

View larger image Yes, the next month was often a coin flip - stocks were lower 50% of the time in the short term. But three months out, the track record was almost spotless. And a year later, the gains were consistent and strong. The reason is simple: when the Fed cuts in a non-recessionary environment - like today - it tends to extend the business cycle and supercharge asset prices. The Stimulus Wave Is Real We're also living through something I call the Stimulus Wave. Back in April, right after the Liberation Day crash, I laid out a thesis that tax cuts, rate cuts, changes to the Supplementary Leverage Ratio (SLR), and a weaker dollar would all converge at the same time. And because markets are forward-looking, those stimulative measures would be priced in well before they were official. That's exactly what happened. The result was not just a massive stock market rally, but also new highs for gold, Bitcoin, and real estate.

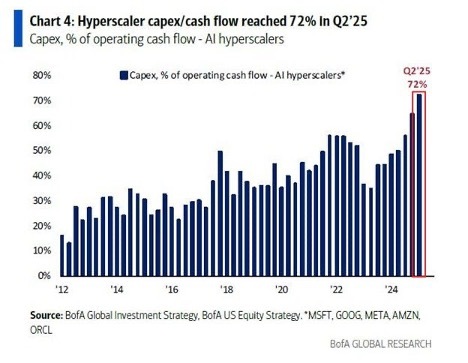

View larger image Now, with Stephen Miran (Trump's Fed pick) reviving talk of the Fed's "third mandate" - moderate long-term interest rates - the next leg of the Stimulus Wave could be yield curve control (YCC). YCC would mean the Fed actively suppressing long-term Treasury yields to keep borrowing costs low. Japan has done it for years. It's highly stimulative, dollar-negative, and asset-positive. If that's where we're heading, this bull market still has plenty of fuel left. AI Spending Boom Is Just Starting Then there's the elephant in the room: artificial intelligence. Many investors worry we're in an AI bubble already. But history says tech booms run much longer than people expect. - The internet took off in the late 1990s and is still creating new use cases today.

- Cloud computing began with AWS in 2006 and is still scaling rapidly.

- The iPhone launched in 2007, and the smartphone market is still growing 15-plus years later.

AI - at least as the public knows it - started with ChatGPT in 2022. We're three years in. That's nothing. The first phase of this cycle was all about model training, which made Nvidia the face of the boom. The next phase - inference, or running those trained models in the real world - is where the real money will be made. And it's just starting.

View larger image That means the AI spending cycle, like the bull market it's powering, has years left to run. The Bottom Line Could stocks pull back in the short term? Absolutely. With technicals stretched, that's almost expected. But long term? The outlook couldn't be better.

View larger image We're still early in a bull market that has years left to run. The Fed is easing, but not because the economy is in crisis. The Stimulus Wave is still rolling. AI spending is just getting started. This is not 2021 all over again. It's not the top. It's not a bubble popping. It's the kind of environment where optimists get rewarded, and where the greatest risk isn't being too early - it's being left behind. And I don't intend to be left behind. Stay safe out there, Robert Want more content like this? | | | | | |

No comments:

Post a Comment