- We’re more attached to our smartphones and the internet now than ever before.

- A deep dive into our Stock Power Ratings system shows you that certain tech stocks are not good investments.

- Today’s Stock to Avoid is a $1.2 billion telecommunications company that rates a “High-Risk” 3 out of 100 on our proprietary system.

|  | A report from Reviews.org found that 74% of Americans were “uneasy leaving their mobile phones at home.”

This speaks to how attached we’ve become to our smartphones.

And that’s thanks in part to how easy it is to access information from all but the most remote locations in the U.S.

While mobile and internet connectivity is strong in the U.S., one-third of the world’s population still can’t get online.

Most of the underserved population reside in Asia and Africa due to poor infrastructure for things like cell towers and fiber-optic cables.

Companies are turning to outer space as a means to provide cell and internet access to all.

But not every company is finding success among the stars.

This is the case with AST SpaceMobile Inc. (Nasdaq: ASTS).

Click here or on the button below to see why.

| From our Partners at Banyan Hill Publishing Take a good look at this building. This is the command center for one of the most devastating plots in American history. A plot that could make the money in your wallet worthless ... and “give federal officials FULL CONTROL over the money going into, and coming out of, every person’s account.” And that’s just the tip of the iceberg.

Go here to get all the details. |

| Traders were shocked last week when data showed that inflation was rising again.

This time, the Federal Reserve’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) Price Index, contained the bad news.

PCE is calculated based on data obtained from businesses. The more popular Consumer Price Index (CPI) gets data from consumers. That difference explains why the Fed prefers PCE.

Here’s why…

The CPI might show that the price of beef is significantly higher than it was last month. Consumers often buy cheaper cuts of beef or substitute other proteins in response. How they react isn’t captured by CPI.

On the other hand, PCE measures how much consumers spend at the grocery store. If they substitute tofu for beef, spending will drop. That will lower the inflation measured by PCE relative to CPI. But PCE is a more accurate measure of the realities of inflation since consumers have to make choices.

That’s where we are now.

| From our Partners at Banyan Hill Publishing. Ian King was thrust into the limelight for turning $350,000 into over $6 million during the worst 19-month stretch of the 2008 financial crisis. Since then, he has identified virtually every major turn of the market — including the three biggest booms of this century. Now, the forces which lit the fuse for those events are converging for an even more epic fourth time.

Click here for full details… |

Food Prices Force Consumers’ Hand At the grocery store, we are being forced to consider alternatives as prices rise.

The Fed’s preferred measure ignores food and energy prices.

Economists say these prices are too volatile and including them distorts the picture of inflation.

Volatility implies prices go up and down. That’s true for energy prices.

Gas prices do move up and down.

But that’s less true for food prices.

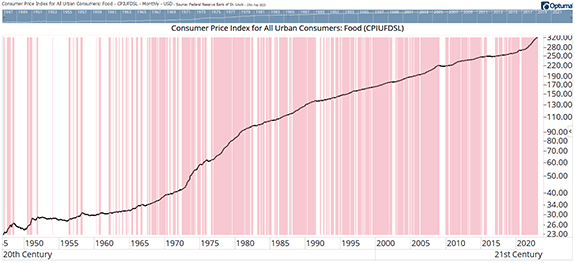

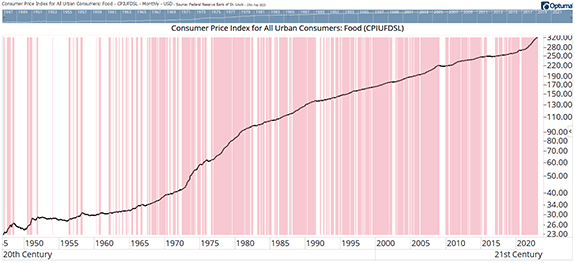

The chart below shows the CPI for food. Red bars highlight times when the index was higher than it was six months earlier. Food Prices Keep Rising  (Click here to view larger image.) Food prices declined for extended periods in the 1940s and 1950s. This was most likely associated with changes in the economy driven by demobilization after World War II and the Korean War.

Since 1970, food prices have consistently marched higher.

Even when inflation was near 2% for much of the 2010s, food costs continued to climb.

Bottom Line: The rate of inflation may slow in coming months if the Fed’s policies are successful. But higher prices are here to stay. That means family budgets will remain stretched for some time. And corporate earnings will reflect that stress.

Note: For more insights from Mike, click here to sign up for The Banyan Edge, a free newsletter that lifts the veil on markets and the economy.

Check Out the Latest From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

No comments:

Post a Comment