| | Amanda Heckman

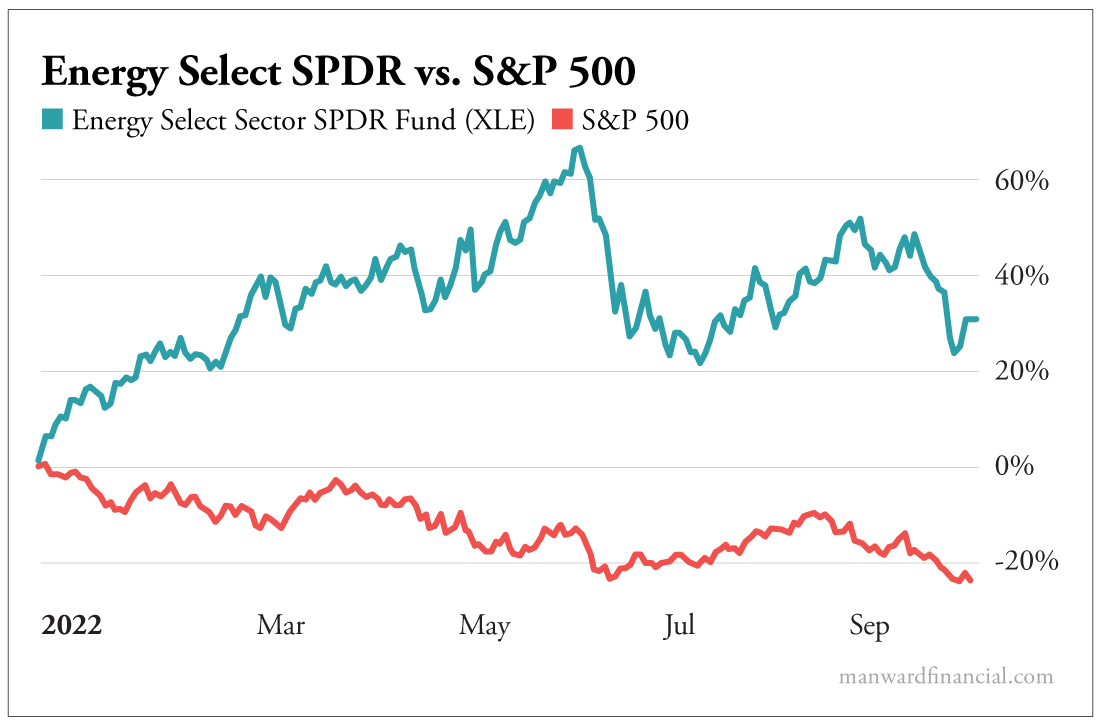

Editorial Director | "When she was good, she was very, very good... and when she was bad, she was horrid." That nursery rhyme popped into my head while I was looking at the top-performing sector in the market this year. It's a sector that has gone through some intense boom-and-bust cycles... and is facing an uncertain future... But this year, it has been very, very good to its investors. [How one entrepreneur's frustration with his daughter's diagnosis could turn his tiny $2,500 solution into a $5 trillion blockbuster. Find Out Here.] In Demand The energy sector is having an interesting year, to say the least. Prices soared as Russia invaded Ukraine earlier in the year and shut off the oil spigot to most of Europe. This came on top of the already-increasing energy demands created by the world shaking off the pandemic to resume traveling and commuting. Simply put, these unique circumstances - plus a push for green energy that's way ahead of reality - have kept the energy sector very much in demand... and have contributed to it enjoying record profits. Manward contributor and Trading Champion Alpesh Patel saw the opportunity earlier this year. In his research service GVI Investor, he made a tactical move in his stock picking to capitalize on the unusual circumstances in energy. (One of his plays locked in 35% gains in just three months!) And in his Stock of the Week videos, Alpesh has spotlighted nearly a dozen energy stocks that have met his stringent criteria for growth, value and income. They keep showing up on his radar because, as he told you Monday, "We're seeing phenomenal numbers. Energy companies are seeing immense momentum and profits right now." And their investors are reaping the benefits... | XRI: The #1 Investment of the Decade Could this new technology spark the biggest investment boom since the internet? Barron's says it's "going to be really, really big." Apple's CEO says that it is one of those "very few profound technologies that we will look back on one day and say, 'How did we live our lives without it?'" While one early investor in Facebook, Twitter and Uber says, "This is the first time that technology has made me feel this excited since I was first introduced to the internet in 1994." It's a technology one guru calls "XRI" that could be the biggest mega-trend of this decade... And he believes one company is at the center of it all... | | | Cash Is King In the third quarter, companies in the S&P 500 Energy Sector Index paid out $16.4 billion in dividends, up 15% from $14.3 billion in the second quarter. That's nice, but here's what's really telling about this year... That $16.4 billion was a huge 49% increase over last year's Q3 payout. Right now, the Energy Select Sector SPDR Fund (XLE) pays a dividend yield of 3.48%. That's higher than the Vanguard High Dividend Yield ETF's (VYM) 3.2% yield. The fund is even beating "Dividend Aristocrats" - stocks that have raised their dividends every year for 25 years or more. The yield on the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is 2.2%. Record demand... record profits... rising dividends... Add it all up and you get a chart like this... While the overall market has struggled - and failed - to fight off inflation, rising interest rates and a host of other economic issues... The energy sector is defying gravity and rewarding investors. | SPONSORED | | Yours Free! Top FIVE Dividend Stocks Right Now Marc Lichtenfeld - income expert and author of Get Rich with Dividends - is giving away his Ultimate Dividend Package... completely free of charge! You'll discover... - An "A"-rated, ultra-safe dividend stock with a huge 8% yield

- Three of Marc's favorite "Extreme Dividend" stocks, which could supercharge your income

- And finally, Marc's No. 1 dividend stock for a LIFETIME of income.

Click here to get the names and ticker symbols now... before the download link expires. **NO CREDIT CARD REQUIRED!** | | | What's the fair value of stocks these days? Are stocks falling because growth prospects really are that much lower? Or are stocks falling because when fear is this high, selling begets selling? Andy has the answers here. Keep reading. In a volatile market, it's not just about making money… it's also about keeping your money. So in this week's special edition of Stock of the Week, Alpesh shares the No. 1 indicator that's been critical to his success. He explains how it works and what it's telling us about the market right now. Click here or on the image below to find out what this indicator is. "The best business in the world is a well-run oil company. The second-best business in the world is a badly run oil company." - John D. Rockefeller Want more content like this? | | | | | Amanda Heckman | Editorial Director Amanda Heckman is the editorial director of Manward Press. With unrivaled meticulousness, she has spent the past dozen or so years sharpening Andy's already razorlike wit... and has worked with numerous bestselling authors and award-winning financial gurus along the way. | | | |

No comments:

Post a Comment