|

The Next Big Profit Sector: Think INSIDE The Box… What unconventional economic times we live in! A maverick stock shorter has found a way to profit off of inflation itself, a former First Lady is getting in on NFTs, and one of the biggest profit sectors has people thinking INSIDE the box. It seems like anything is possible nowadays…

There are two kinds of people in this world:

Those that profit from shorting stocks…and those who feel that hell is holding a special place for all shorters.

These kinds of investors disrupt the market in ways that will make some people pull their hair out.

And did I mention I’m bald? So what does that tell you?

In my OLD profession, if I had the ability to do so, I’d have collected every last stock-shorter, put them in a big burlap sack, and beat it with a baseball bat.

That’s how much I hated them…

Every shorting would absolutely DESTROY my stock advertising campaigns, so, to say I held shorters in contempt would be an understatement.

However, I’ve had the better part of a decade to get over that, and now I see the ability to short a stock as simply another investment tool.

Of course, I can’t wrap my head around betting on something to lose—doesn’t that just seem like a negative way to live?—but that doesn’t mean I have to be mad at it.

Plus, the backlash gave rise to the MEME stock when a whole host of people from all walks of life collectively decided to stick to the shorters as well. It started with the GameStop (GME) saga and has continued to this day.

However, even though shorters lost their shirts during the MEME stock wars, it hasn’t stopped them from buying a whole new wardrobe—and they can afford to do it because these guys have still been killing it in the markets. Killing It Like A Shorter Last year, Bill Ackman, famed investor and hedge fund manager, shorted the credit market with a $27 million bet—and when that bet paid off, he walked away with a $2.6 billion windfall.

Say what you want about shorters, but they’re in it to win it.

Well, Ackman’s back at the shorting game—only this time he’s betting on inflation instead of credit.

This investment maverick just put in a $170 million bet that inflation will continue to rise—and it’s a bet that has already paid off a whopping $1 billion so far, with a LOT more gains to be had.

However, Ackman isn’t shorting everything.

Instead, he’s figured out which trades have the highest “asymmetry” (trades that could return a lot more if he’s right than he’ll lose if he’s wrong) and implemented them as a hedge for the rest of his portfolio.

What’s that mean?

Basically, Ackman accumulated a huge short position in short-dated bonds earlier this year by buying cheap, out-of-the-money options, which is how he turned that $170 million into a quick $1 billion.

That’s more than a six-fold return. Must be nice, right? Hedge Fund Profits And while the trade has already performed exceptionally well, Ackman doesn’t appear to have taken his profits yet, which most likely means he sees even more gains on the horizon.

However, as I said, Ackman isn’t shorting everything. Remember, he’s a hedge fund manager, and so the rest of his portfolio isn’t as aggressive. He holds long positions in companies that are better suited to handle higher interest rates and rising inflation.

Some of the long plays in his portfolio include Chipotle (CMG), Lowe’s (LOW), and Hilton Worldwide (HLT), among a few others.

So…how’s he doing it?

Well, it comes down to options—which is one of the trickier ways to invest.

Bill Ackman’s inflation hedge isn’t for the faint of heart, but if you were looking to go down that path, then you could look at buying put options on cheap and liquid short-term bond ETFs.

Of course, I’m not an expert, but there are some plays that are well-suited for this kind of thing. You could buy a put option on something like the Vanguard Short-Term Bond ETF (BSV) or the iShares 1-3 Year Treasury Bond ETF (SHY).

Of course, you’re taking your financial future into your own hands if you do that alone.

If you want a better education into options, then you might want to talk to Adam O’Dell. His Home Run Profits service deals strictly with options and how to trade them.

You can learn more about it HERE.

Either way, the takeaway from all of this is that those in the know seem to think that inflation is just starting its upward climb.

It may be prudent to find a way to profit from it rather than just be a victim of it, right?

There are certain things we take for granted in life, but it’s about time we stopped and counted our blessings. All too often, we overlook things like clean air, shelter, water, and quality product packaging.

Yes, packaging. Think about it: most things you buy—unless, of course, they happen to be NFTs—require physical packaging of some kind.

It is an essential and lucrative business that too many consumers take for granted and too many investors ignore.

The packaging industry, like Rodney Dangerfield, can’t get no respect…no respect at all.

But packaging is absolutely critical to everyday life, particularly in our post-pandemic retail environment where people shop online.

Think about that the next time you sip from your (usually controversial) Starbucks holiday cup (packaged and shipped from a cup-making facility), throw the cup into a trash bag (packaged inside a box of its own), and then go pick up your Amazon delivery (again…packaged).

Ah, yes…now you see how important the packaging people are to your life, don’t you?

Well, if all the gift-wrapping of the holiday season has you wanting to get in on the packaging industry too, you should consider buying shares of THIS company.

The potential for big returns might just surprise you…

Interested? [Click Here To Read More]

Author’s note: The following is NOT a political article. This article is simply to educate people on what the heck an NFT is!

Reader discretion…unnecessary. ***** Former First Lady Melania Trump has announced that she is launching her own non-fungible token (NFT) initiative, with the proceeds going to a charity dedicated to helping kids who age out of foster care.

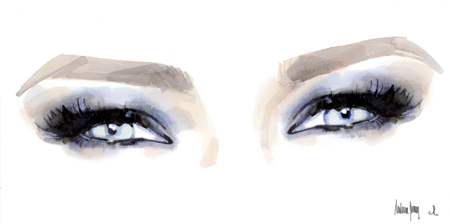

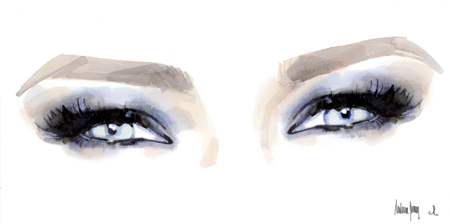

Buyers have until the end of the month to purchase the former First Lady’s NFT, which comes in the form of a watercolor painting that the artist Marc-Antonine says, “embodies Mrs. Trump’s cobalt blue eyes, providing the collector with an amulet to inspire.”

The digital artwork will be sold using a form of cryptocurrency equivalent to $180, and also includes an audio recording of Mrs. Trump.

In a statement, Melania Trump said, “I am proud to announce my new NFT endeavor, which embodies my passion for the arts, and will support my ongoing commitment to children through my Be Best initiative.” She added, “Through this new technology-based platform, we will provide children computer science skills, including programming and software development, to thrive after they age out of the foster community.”

Trump’s new NFT can be purchased on her website and can also be obtained with a credit card. What Is An NFT? Now, in all this, if you haven’t been following along with Money Moves’ ongoing “Crypto Journey” series, you may be wondering, “what is an NFT?”

Don’t worry, you aren’t alone. NFTs are the latest craze among investors and can be hard to comprehend because the product being purchased doesn’t come in a physical form.

NFTs are digital “assets” that use blockchain technology to set one asset apart from another. Once an NFT is created, it cannot be replicated.

Blockchain is a decentralized digital ledger that documents transactions, ownership, and validity so that each NFT can be tracked.

NFT’s include, jpegs, and video clips, and some are going for top-dollar.

Here’s a more in-depth explainer from Money and Markets research analyst Matt Clark:

Arguably the most famous NFT sold was Twitter founder Jack Dorsey’s original tweet.

In 2006, Twitter Inc. CEO Jack Dorsey created his first tweet on his Twitter platform. Fast forward fifteen years, and Dorsey‘s NFT screenshot of that tweet sold for $2.9 million to Oracle Corp. CEO Sina Estavi.

The former First Lady’s press statement also stated that she would be releasing NFTs in regular intervals, with a one-of-a-kind auction of historical importance scheduled for January 2022.

For more quality content like this, and to learn more about the Money Moves team, visit us at https://moneyandmarkets.com/category/money-moves/ | | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | |

No comments:

Post a Comment